tucson sales tax calculator

Tax Paid Out of State. Sales tax in Tucson Arizona is currently 86.

How To Calculate Sales Tax For Your Online Store

The calculator will show you the total sales tax amount as well as the county city.

. The Arizona sales tax rate is 56 the sales tax rates in cities may differ from 56 to 112. Below you can find the general sales tax calculator for Tucson city for the year 2022. This is the total of state county and city sales tax rates.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required. As we all know there are different sales tax rates from state to city to your area and everything. The Arizona sales tax rate is currently 56.

How to Calculate Arizona Sales Tax on a Car. Tucson Sales Tax Rates for 2023. This is a custom and easy to use sales tax calculator made by non other than 360 Taxes.

Tucson AZ Sales Tax Rate Tucson AZ Sales Tax Rate The current total local sales tax rate in Tucson AZ is 8700. To calculate the sales tax on your vehicle find the total sales tax fee for the city. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required. Sales Tax Calculator in Tucson AZ. Method to calculate Corona de Tucson sales tax in 2021.

Method to calculate Tucson Estates sales tax in 2022. Method to calculate Tucson Meadows Mobile Home Park sales tax in 2022. Multiply the vehicle price.

You can use our Arizona Sales Tax Calculator to look up sales tax rates in Arizona by address zip code. The minimum is 56. Tucson in Arizona has a tax rate of 86 for 2023 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in Tucson totaling 3.

The minimum combined 2022 sales tax rate for Tucson Arizona is 87. Name A - Z Sponsored Links. Price of Accessories Additions Trade-In Value.

Method to calculate South Tucson sales tax in 2021. The average cumulative sales tax rate in Pima County Arizona is 814 with a range that spans from 61 to 111. The sales tax rate for Tucson was updated for the 2020 tax year this is the current sales tax rate we are using in the Tucson Arizona Sales Tax.

South Tucson in Arizona has a tax rate of 10 for 2022 this includes the Arizona Sales Tax Rate of 56 and Local Sales Tax Rates in South Tucson totaling 44. The December 2020 total local sales tax rate was also. This includes the rates on the state county city and special levels.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required. The average sales tax rate in Arizona is 7695 The Sales tax rates may differ. You can find more tax rates.

Missouri Car Sales Tax Calculator

2022 Hyundai Tucson Monthly Car Payment Calculator U S News

Car Tax By State Usa Manual Car Sales Tax Calculator

Las Vegas Sales Tax Rate And Calculator 2021 Wise

Kentucky S Car Tax How Fair Is It Whas11 Com

Do This To Save 16 On Every Marijuana Purchase In Arizona

Sales Tax Rate Changes For 2022 Taxjar

Recent Arizona Tax Law Changes Beachfleischman Cpas

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

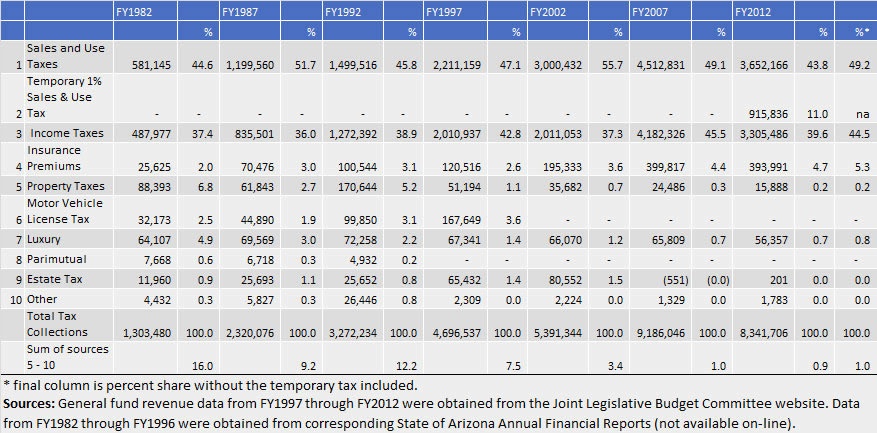

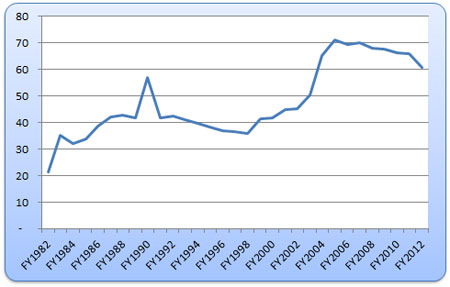

Arizona General Fund Tax Revenues An Historical Perspective Arizona S Economy

/cloudfront-us-east-1.images.arcpublishing.com/gray/JCDRKZDCRBB5VACKOC2VRNUTMM.jpg)

Tusd Property Tax Rate Soars Due To State Budget

![]()

Georgia New Car Sales Tax Calculator

How To Calculate Sales Tax For Your Online Store

Arizona General Fund Tax Revenues An Historical Perspective Arizona S Economy

Arizona Poised To Move To A Flat Tax Rate Beachfleischman Cpas

Sales Tax Rates In Tucson And Pima County Pima County Public Library

Arizona Sales Tax Relatively High Many Valley Rates Mostly Stable